The entire banking sector is in liquidity deficit due to Shariah banks

The entire banking sector is in liquidity deficit due to Shariah banks

Many a time the central bank has a large current account deficit of Shariah-based banks. Due to this, the entire banking sector has fallen into liquidity deficit.

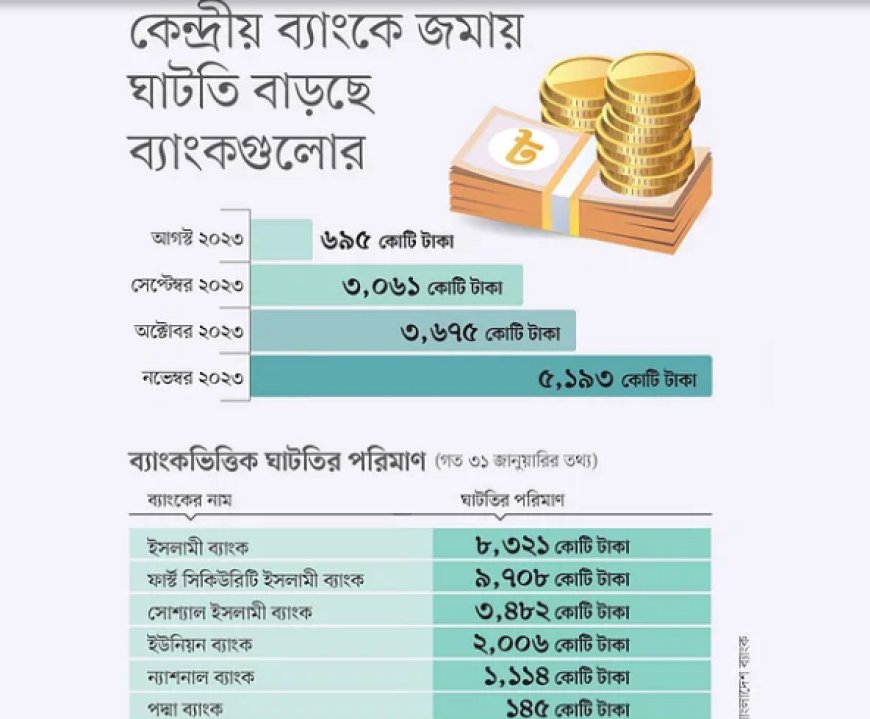

Banks are compulsorily required to deposit a portion of deposits with the central bank to safeguard customer deposits or deposits. However, six Shariah-based banks and two conventional banks, including Islamic banks, are unable to deposit money in the central bank as required. As a result, the current accounts of these banks with the central bank sometimes fall into large deficits. Due to this large deficit in some banks, there is a shortfall in the deposit protection funds of the banks deposited with the central bank. At the end of last November, this deficit stood at 5 thousand 193 crores. This information is known from the December report of the central bank.

Last November, the country's banks had an obligation to deposit 71 thousand 52 crore rupees with the central bank in terms of cash deposits (CRR); But the banks were able to deposit 65 thousand 859 crores. Banks that are not in liquidity crunch have deposited more than the required amount due to CRR, but the total central bank deficit is over Rs 5000 crore. Basically, some Shariah-based banks are unable to deposit money due to CRR. Banks which are not able to deposit CRR amount are paying penalty, they are also not able to deposit penalty.

Bangladesh Bank officials say that some banks are facing major liquidity crisis. As a result, this crisis is spreading across the sector. Due to which the good banks of the country are facing many questions at home and abroad. Global quality assurance organizations in particular face many questions.

Banks that have created this shortfall include Islami Bank, Sajij Islami Bank, First Security Islami Bank, Global Islami Bank, Union Bank, ICB Islami Bank, Padma Bank and National Bank. After various irregularities there has been a change in the management, ownership and management of the traditional Padma Bank and National Bank. However, the Central Bank has not taken any action regarding Sharia-based banks.

Association of Bankers Bangladesh (ABB) Chairman and Managing Director of BRAC Bank Salim RF Hossain told Prothom Alo in this regard that the lack of CRR is not good news for the entire banking sector. Local customers transact with bank-based inquiries. This may not be a problem in the confidence of banks. But foreign credit rating agencies, foreign banks and foreigners will not look favorably on this deficit. They review these indicators and take various decisions. The central bank must be taking steps to get rid of the banks that caused this situation.

What's Your Reaction?